Financial Places | Property Enhancer

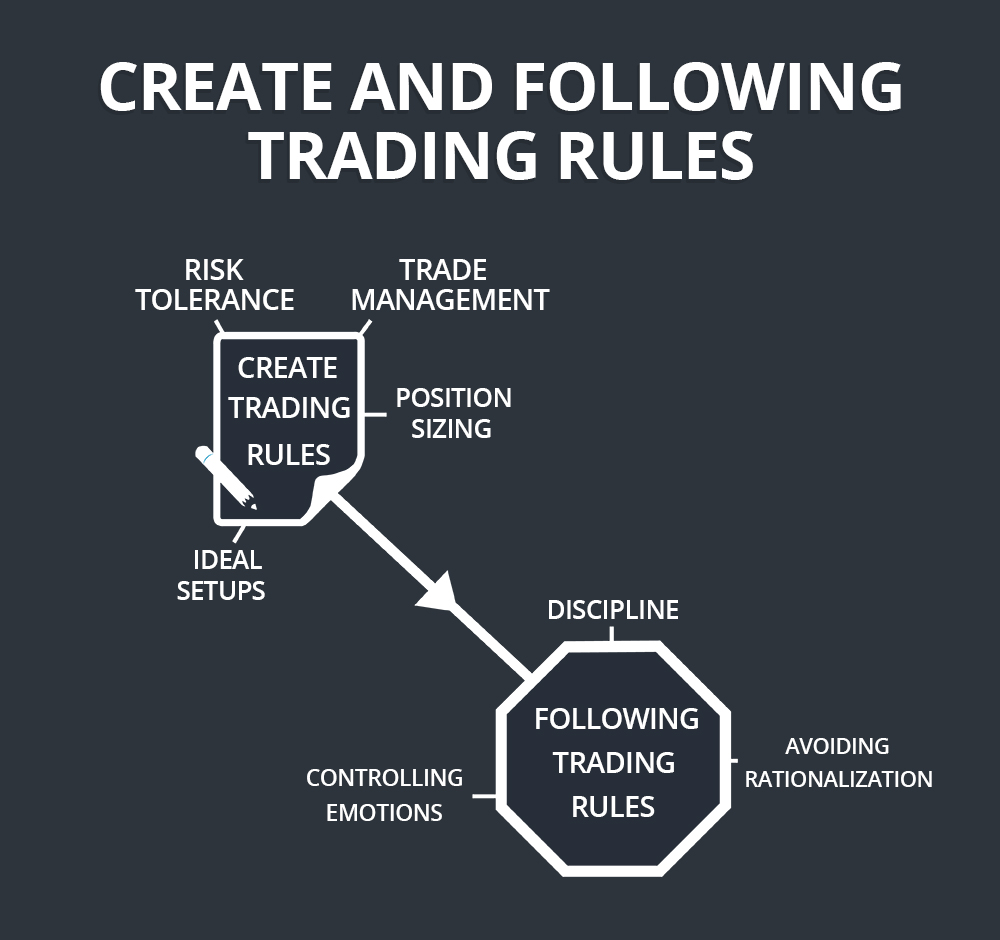

Specific provide a flat-it-and-forget-they robo-advisory service (much more lower than). Of a lot offer instructional material on the sites and you can cellular programs, which can be ideal for beginning people. What exactly is their threshold to have chance (the possibility that you can even lose money while you are paying)? Carries try categorized in various means, for example large capitalization brings, brief cap carries, aggressive gains holds, and cost holds. After you dictate your own exposure threshold, you could potentially place your investment views on the holds one to complement it.

In the event the risk-averse, choosing stocks and choices, is almost certainly not the first choice. Generate a strategy, explaining how much to spend, how often to expend, and what you should purchase considering needs and choices. Just before allocating their resources, check out the address financing to ensure it aligns together with your means possesses the potential to deliver need overall performance.

Any kind of the risk threshold, among the best a way to perform exposure is always to own multiple various other investments. To shop for “physical” merchandise form holding levels of oil, grain and you can silver. As you might think, this is not just how many people buy commodities.

The brand new Amsterdam Stock-exchange is created in 1602, and the Nyc Stock-exchange (NYSE) inside the 1792. Very which of them if you use to build your retirement profile? The solution will be crisper when you know how to like investment. One feeling is very solid when rising cost of living is actually high, however it is along with genuine during the regular many years when rising cost of living are powering 2% or step 3%.

Alternatives deals is actually a famous derivative providing you with the buyer the fresh right yet not the responsibility to purchase otherwise offer a safety from the a fixed speed within a specific time period. Derivatives usually utilize influence, making them a high-risk, high-award suggestion. Risk and you will get back criterion can vary generally inside exact same advantage group. Such as, a bluish chip you to investments on the New york Stock market are certain to get a very other risk-come back character of a small-limit one deals for the a small exchange. One method to choose simply how much risk to take is always to concentrate on the form of economic mission you are operating to your.

They’re a great way for starters to get started paying as the they often times want almost no currency and they create a lot of the task for you. That’s not to say you shouldn’t remain attention on the membership — this is your money; you never desire to be entirely hands-away from — however, a robo-coach can do the new hard work. To many other paying requirements, for example to find a home, travel or training, consider your go out vista and the count you would like, following work in reverse to-break one to number down into monthly or each week opportunities. You will see ups and downs on the stock exchange, of course, however, paying young form you have got ages to help you trip him or her aside — and you can ages for the currency to expand. If you’re also troubled regarding the if the contribution will be enough, attention alternatively on which count seems down provided your financial situation and requirements. A large number of such enjoyable strong technical startups is actually located in European countries, as well as their founders try eventually looking funding more easily available on house grass.

Bear in mind that, the higher the new MER, the greater amount of it influences the new fund’s total go back. Quite often, their broker often costs a payment whenever you change brings, whether you get otherwise offer. Particular brokers charge zero trade commissions whatsoever, nonetheless they make up for it with other charges. After you join an idea, contributions are created instantly for a price you place.

- Yet not, the entire stock-exchange has usually introduced mediocre production away from nearly 10% annually.

- Such, a Treasury bond or AAA-rated corporate bond is an incredibly reduced-risk investment.

- If you make wise conclusion and invest in the right cities, you might slow down the exposure foundation, increase the prize basis, and you will build important production.

- But not, without having a retirement plan at the office or if you need to enhance one package, you might open a single account such IRA.

- Nonetheless other people may offer a certain number of percentage-totally free deals for beginning an account.

So it features your collection continuously and securely increasing throughout the years. While they aren’t positively treated, ETFs usually cost a lower amount to buy than simply common fund. And you can usually, hardly any definitely managed common financing features outperformed its standard indexes and you may inactive fund long lasting. Ties ensure it is people so you can “get to be the financial.” When businesses and you can countries need raise investment, it borrow money away from investors from the issuing personal debt, entitled bonds. Enterprises offer inventory to boost currency to cover its business surgery.

If you have a low risk threshold but require large productivity than simply you might get of a savings account, thread opportunities (or bond financing) was right. You might find the do-it-your self route, trying to find investments based on your paying layout, or join the help of a good investment professional, such a mentor otherwise agent. Just before paying, you should know very well what your preferences and you will exposure endurance is actually.

Although not, with using, you are taking for the more chance inside expectation from high output. Each other type of money often individual thousands of holds or any other assets. This makes him or her a more varied alternative than just an individual inventory. Because of the owning a range of opportunities, in almost any organizations and different advantage kinds, you can buffer the new loss in one city on the progress in another.

They could supply a host of funding products and informative info. They have generally focused in order to higher-net-worth somebody and regularly want tall investments. Dismiss brokers provides reduced thresholds to own accessibility, but have a tendency to provide a far more streamlined band of characteristics.

Instances is hypothetical, and we encourage one search personalized advice away from certified pros of particular money items. Our quotes are based on prior field performance, and you will prior results is not a promise from upcoming performance. You will find different varieties of funding automobile, for example holds, bonds, mutual fund, and you can home, for every carrying some other quantities of threats and you may benefits. If controlling to own retirement ‘s the employment assigned to your finances, old age profile, such as a 401(k) otherwise just one retirement account, give use of financial areas and supply taxation benefits. There are a variety away from retirement profile; area of the distinctions matter the newest percentage of cash taxation, if you could open the newest account separately otherwise as a result of an employer and you may share constraints.

Yet not, lately, choice investments was delivered in the financing types that are accessible to help you merchandising traders. Actually, buyers pay nearly nine minutes more within the charge for earnestly addressed common money. Prefer a catalog finance, and more of your own currency stays in your own collection to enhance over time. The price of you to management, in addition to expenditures to have trades, government, sales information, etcetera., arrives of the funding output.

Do you know the Dangers of Paying? – dotbig broker

The type of money you decide on might likely trust you that which you seek to acquire and just how delicate you are to help you chance. And when little exposure basically output all the way down productivity and you may the other way around for and when high-risk. Investment can be produced inside carries, bonds, home, metals, and more. Spending can be made which have currency, assets, cryptocurrency, or any other methods of replace. Surprisingly, you could potentially purchase a house having $step 1,100. You may not be able to get an income-producing assets, you could buy a buddies you to definitely really does.

In addition to, you could potentially purchase smaller to begin with having a financing than simply you’d probably spend to buy private stocks. Should you decide promote these brings, the newest round trip (the fresh act of purchasing then promoting) manage charge you a total of $a hundred, or 10 percent of your own first put amount of $step 1,one hundred thousand. These will cost you alone is eat into the balance prior to the investments need the opportunity to earn a confident go back. Variation is an important investment style to understand. In a nutshell, because of the committing to a variety of possessions, otherwise diversifying, you slow down the chance this one funding’s overall performance can be severely hurt the newest come back of the complete investment profile. You may think from it since the economic slang to own not getting all egg in a single container.

Generally, monetary dotbig broker advisers suggest you’re taking on the far more exposure once you’re paying to have a far-of goal, including whenever young people purchase to possess later years. If you have years and you may many years before you can you need your finances, you’re also basically inside the a much better reputation to recover from dips within the your investment well worth. Since there are no protected efficiency and individual enterprises may go bankrupt, holds include higher risk than just other assets. Another application option is Stash, that helps show student traders how to build their particular profiles of ETFs and you may individual carries.

Index financing and you can ETFs are typically reduced-prices and simple to manage, as it can capture merely four to five financing to create adequate variation. Should your savings mission is over twenty years aside (including retirement), most your money is going to be in the stocks. However, selecting specific brings is going to be tricky and frustrating, so for most people, how you can buy carries is by using reduced-costs inventory common financing, list fund otherwise ETFs.

Tips Purchase Money Faqs

You to definitely suits is free money and you will a guaranteed come back in your money. For long-name desires, your profile could be more competitive and take more risks — potentially leading to higher productivity — so you might opt to individual much more brings than simply bonds. Specific accounts provide income tax professionals when you are paying to possess a specific mission, such as retirement. Understand that you happen to be taxed or penalized when the you pull your money away early, or for a conclusion maybe not felt licensed by package laws and regulations. Other account are general-purpose and really should be used to have requirements not related to senior years — you to dream vacation household, the brand new ship to go along with it or just a secondary, several months.

As the account is funded, you will need to pick and choose your investment. Stock market simulators offer pages imaginary, digital money to purchase a collection of holds, choices, ETFs, or any other bonds. Such simulators typically track rates actions of assets and you will, with respect to the simulator, other renowned factors such change charge otherwise bonus earnings.

While you are investing for a low-retirement goal, brokerage profile also offer use of stocks, securities, money or other investments. Using is a relationship away from tips now on the the next financial mission. There are various amounts of chance, which have certain asset kinds and you may money items naturally much riskier than simply anyone else. It will always be likely that the value of your investment tend to perhaps not improve throughout the years.

Once you happen to be ready to take on specific chance to expand your currency along side long term, investing the market is one of the most common towns to do this. Chance in the spending refers to the likelihood of dropping certain (otherwise, rarely, all) of your own money you have spent. Opportunities exposed to lowest risk often build reduced otherwise average returns; opportunities you to definitely bring high-risk offer the possibility highest benefits. If you’d like an algorithm to make funding conclusion for you, and to possess taxation-losings harvesting and you may rebalancing, an excellent robo-advisor may be for you.

The organization released later years account this year, and will be offering 3% right back on the cash as it attempts to broaden from slumping exchange costs. Robinhood’s co-maker and you may Chief executive officer Vlad Tenev told CNBC one to people had been stepping into dollars, currency market money and you will thread ETFs. The guy indexed more chatter inside Bogleheads’ Reddit category, rather than the brand new infamous Wall surface Highway Wagers. In addition to undertaking a broker account and buying brings in person, there are several a means to invest in the market.

There are various methods for you to purchase money, in addition to stocks, ties, mutual money, exchange-replaced finance (ETFs), licenses of deposit (CDs), deals account, and much more. Your best option to you utilizes your unique exposure endurance and you may monetary needs. Certain investors opt to invest according to suggestions from automated economic advisers. Run on algorithms and you may phony intelligence, roboadvisors collect crucial factual statements about the fresh buyer and their risk character making compatible suggestions. With little to no person interference, roboadvisors render a payment-effective way of paying having functions like just what an individual financing advisor now offers.

Such as, if a flood affects the supply away from grain, the expense of grain you are going to raise on account of scarcity. Once you spend money on bonds, you’re also loaning money to your issuer to own a fixed age of date. In return for your loan, the fresh issuer will pay your a predetermined rate from go back since the well as the currency you first loaned them.

From the spending your finances on a regular basis, you’re in a position to increase they a couple of times more with day. That is why you should start using as early as possible and also as in the future as you have some funds saved regarding mission. It doesn’t matter how you opt to initiate investing, keep in mind that paying try an extended-identity process and that you’ll experience the very best professionals by consistently spending over time. That means staying with a financial investment approach whether places are right up or off.

There are numerous investment available for apparently small amounts, for example list fund, exchange-exchanged finance and you will mutual finance. It’s also smart to eliminate people highest-desire financial obligation (such as playing cards) before you begin to spend. Look at it that way — the stock market features typically delivered output from 9% to ten% a-year over-long periods.

Economists consider paying and you may rescuing as a few corners of one’s exact same money. It is because when you save money by placing within the a great bank, the lending company then lends those funds to people or companies that want to use those funds to get they in order to a great fool around with. Thus your own discounts can be somebody else’s investment. And normal money, such a dividend otherwise focus, speed appreciate is a vital component of get back. Total go back from a financial investment can be therefore be looked at the fresh amount of income and you will financing appreciate.

While you are an investment can get lose money, it will take action because the enterprise inside doesn’t send. The results from betting, as well, is due purely to possibility. As the speed volatility is a common way of measuring risk, it seems logical one to a staid bluish-processor chip is much much safer than an excellent cryptocurrency. Therefore, to shop for a dividend-using blue-chip with the hope out of holding it for some decades do be considered because the paying. Simultaneously, an investor just who expenditures a great cryptocurrency to flip they to own a good small money inside a few days is in fact speculating. The newest twenty-first millennium along with opened the industry of investing to beginners and you can unconventional investors by saturating the marketplace having write off online funding businesses and you will totally free-change applications, such as Robinhood.

That is amazing you determine to get one express from stock inside the each of five enterprises along with your $1,one hundred thousand. Just in case an exchange commission out of $ten, you are going to bear $fifty inside change costs that’s equal to four % of your own $1,100. Exactly how much you need to invest depends on your debts, financing purpose and in case you need to reach it.

For example, with only $step 1,000, you can even simply be able to invest in two enterprises. Some investors should take a dynamic hand-in dealing with the investments, while others choose to set it up and forget they. Your preference will get alter, but select a method to start.

Stocks

You could buy a home by purchasing property, building otherwise a piece of house. A house opportunities are very different inside the exposure peak and therefore are subject to many items, such as financial time periods, offense cost, public-school recommendations and you can local government balance. Consider what objective you’re trying to reach by investing and you can your time and effort panorama, how much time you must dedicate before getting one to objective. Should your time vista to your objective is short, spending is almost certainly not the best choice for you. Listed below are some our very own report on tips purchase to own small-term otherwise enough time-term needs.

But if the Diy station does not appear to be it will be the cup teas, no worries. Get this to delivered to your own inbox, and more information on our products and services. While you are far from a good meme inventory, the brand new proceed to fixed income you are going to remain risky. Rating stock suggestions, collection suggestions, and in the Motley Fool’s advanced services. Spending currency may seem intimidating, especially if you have never over it prior to. This is actually the difficult matter; unfortunately, i don’t have the greatest respond to.

Standard & Poor’s quotes you to since the 1926, dividends have provided nearly a third from complete security come back to own the newest S&P five-hundred if you are money growth has provided a few-thirds. Money development are thus an important little bit of investing. Investing, generally, is actually getting money to operate to possess an occasion in the some sort of investment or performing in order to build self-confident efficiency (i.elizabeth., winnings one go beyond the level of the original funding). Simple fact is that work from allocating info, constantly financing (i.e., money), with the hope of making a living, profit, or progress. You to definitely glance at the historic speed away from come back of your biggest asset classes shows that the stock market is about to render the greatest screw for the bucks. Usually, the new inventory market’s mediocre yearly go back try ten% prior to rising cost of living; most other advantage kinds barely started next to one.

Think about, you don’t need to tons of money to start, and you can tailor since your demands changes. So it personalized-customized guidance warrants the better charge that they usually costs, versus almost every other brokers. These can is a portion of your own deals, a percentage of your own property under administration, and frequently, a yearly subscription payment. Common financing and ETFs purchase carries, ties and merchandise, after the a particular strategy.